RiteWayMortgages delivers Value, with the best possible mortgage at the lowest cost.

- RiteWayMortgages fixed fees assure maximum savings regardless of loan size.

- We have some of the lowest 3rd party (Title, Escrow, Appraisals, and Notary) fees. We have negotiated with the various 3rd parties to get you the best deal possible.

- We can provide you with a mortgage to suit your needs and this includes Conventional, Super Conventional, Jumbo, Super Jumbo, ARM, FHA, and VA, while focusing on these products and services we can get you the best deal possible while providing the highest level of customer service.

- RiteWayMortgages Optimizer™ software helps find a mortgage tailored to your specific need. A Loan Officer will run a FREE custom report utilizing RiteWayMortgages Optimizer™ software to show you the best mortgage loan for your specific situation.

Refinancing

When refinancing there is a number of questions borrowers are faced with:

- Borrower has been paying an existing loan for 3 years and is planning on staying in this home for another 7 years does it make sense for the borrower to refinance.

- Borrower has been paying an existing loan for 5 years and is planning on staying in this home for ever does it make sense for the borrower to refinance.

- Borrower is not sure if they should buy-down the interest rate.

The RiteWayMortgages Optimizer™ software is designed specifically to answer the above questions; all that’s needed is the following:

- The borrower’s current loan amount.

- How long does the borrower plan on staying in this home?

- How many months has the borrower been paying the current mortgage.

- What is the interest rate on the current loan?

- Based on the answers the borrower provides the RiteWayMortgages Optimizer™ software will create a custom report providing the borrower with answers to the above questions. Look at the examples below.

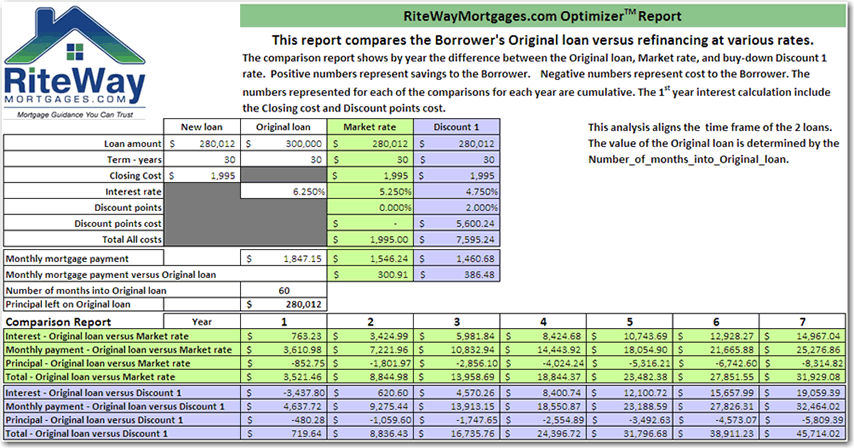

RiteWayMortgages Optimizer™ Refinance Example 1 – The borrower has been paying an existing loan for 3 years and is planning on staying in this home for another 7 years does it make sense for the borrower to refinance, and should the borrower buy-down the interest rate:

- Borrower original mortgage loan is $300,000

- Borrower is planning on staying in this house for 7 years.

- Borrower has made 37 payments on the current loan.

- The current loan interest rate is 6.25%.

- The Market rate scenario in the report above shows that at 5.25% interest rate, after 7 years the borrower will save $16,642 in interest versus the Original loan, and $21,377 in monthly payments, the borrower however will be paying $2,739 less toward the principal, for an overall savings of $35,280 over the Original loan.

- The Discount 1 rate scenario in the report above shows that at 4.75% interest rate, after 7 years the borrower will save $20,858 in interest versus the Original loan, and $28,780 in monthly payments, the borrower however will be paying $159 less toward the principal, for an overall savings of $49,479 over the Original loan. This shows that paying 2% in discount points to buy-down the interest rate to 4.75% would cost an additional $5768 and would save the borrower $14,164 over the Market rate price.

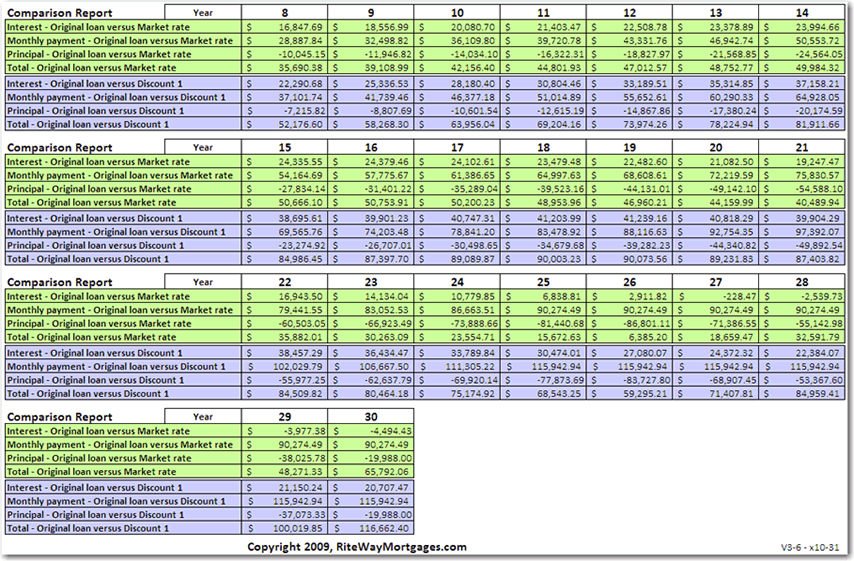

RiteWayMortgages Optimizer™ Refinance Example 2 – The borrower has been paying an existing loan for 5 years and is planning on staying in this home for ever does it make sense for the borrower to refinance, and should the borrower buy-down the interest rate:

- Borrower original mortgage is $300,000

- Borrower is planning on staying in this house for ever.

- Borrower has made 60 payments on the current loan

- The current loan interest rate is 6.25%

- The Market rate scenario in the report above shows that at 5.25% interest rate, after 30 years the borrower would pay $4,494 more in interest then the Original loan, the borrower would save $90,274 in monthly payments and the borrower will be paying $19,988 less toward the principal, for an overall savings of $65,792 over the Original loan.

- The Discount 1 rate scenario in the report above shows that at 4.75% interest rate, after 30 years the borrower would save $20,707 in interest versus the Original loan, the borrower would save $115,942 in monthly payments and the borrower will be paying $19,988 less toward the principal, for an overall savings of $116,662 over the Original loan. This shows that paying 2% in discount points to buy-down the interest rate to 4.75% would cost an additional $5,600 but would save the borrower $50,870 over the Market rate price.

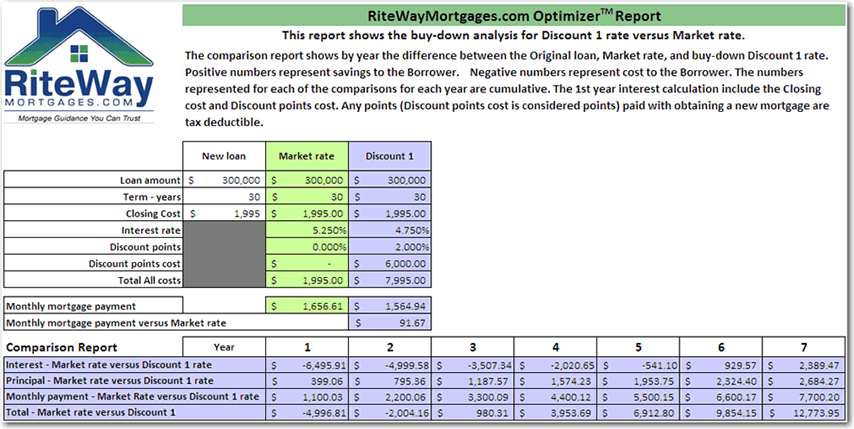

Purchasing

When purchasing a home one of the question borrowers are faced with is should they buy-down the interest rate.

The RiteWayMortgages Optimizer™ software is designed specifically to answer that question.

RiteWayMortgages Optimizer™ Purchase Example 1 – The borrower needs a $300,000 mortgage, and is planning on staying in the home for a number of years, should they pay 2 points to buy-down the rate to 4.75%

- If the borrower will keep this mortgage for 3 years, the Discount 1 rate will save $980 over the Market rate, after 7 years the borrower will save $12,773, and if the loan is kept for the duration the borrower would save $58,006. This shows that paying 2% in discount points to buy-down the interest rate to 4.75% would save the borrower a significant amount of money over the life of the loan.